The August release of our wholesale, balancing and asset value report for GB, looking at July, includes the addition of a new benchmark battery valuation section. This section shows how much profit a battery could have made through an energy trading business model, operating in the wholesale markets and balancing mechanism, using Aurora’s battery dispatch algorithm against outturn prices. In addition, the gas recip benchmark valuation analysis has been updated.

Other highlights of the report include:

- The continued rise in fuel prices and power demand resulted in a rise in July’s average wholesale price to £27.8/MWh – a 9% increase from June; the 8% increase in power demand resulted in a 34% (or 1.6 TWh) rise in thermal generation and a consequent 22% (or 0.7 MtCO2) increase in emissions relative to June

- Balancing action volumes fell by 10% relative to June as the increase in demand resulted in fewer periods where system stability was an issue for National Grid

- Operational gas recips saw reduced volumes in the balancing mechanism, with cashflows ranging from £1-3k/MW, as requirements for balancing actions were reduced

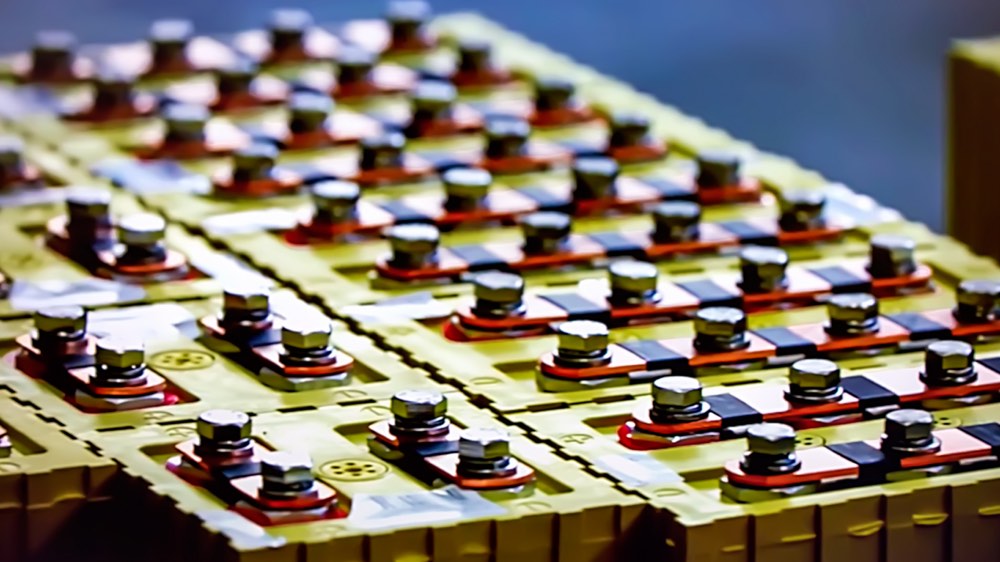

- Theoretical batteries under Aurora’s algorithm would have made £3-4k/MW, depending on duration and cycling rate, with captured price spreads ranging from £42-48/MWh

This is subscriber-only content. Not a subscriber yet? Find out more about our GB Power package.