Powering strategic energy decisions

Globally bankable insights

Trusted by experts, Aurora’s analytics ensure accuracy, reliability, and strategic foresight. Our data helps sector leaders confidently navigate renewable energy transitions.

0 +

Trusted by industry leaders

Expertise you can bank on

With a foundation of proprietary intelligence, Aurora delivers trusted performance to over 750+ global businesses.

Trusted by industry leaders

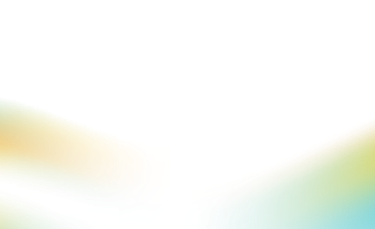

Integrated energy intelligence with EOS

EOS is Aurora's unique, interactive energy intelligence platform, providing clients with seamless access to software, data, forecast reports, and insights essential for strategic decision-making.

Used by thousands of energy market professionals each week globally, EOS serves as the central hub for all our software and research subscription services, enabling users to efficiently access our intelligence, whatever their use case.

Asset Lifecycle Management tools

that meet your needs

Subscription Analytics

Software

Co-located BESS/PV asset with hybrid PPA

Ongoing offshore wind portfolio evaluation

Debt-financed multi market - portfolio

| Strategy & Planning  | Project Siting  | Design & Optimisation  | Investment analysis  | Financing & M&A  | Portfolio Management & PPAs  | Ongoing Valuation | |

Bankable scenarios & insights |   |  |  |   |   |   |   |

Bankable storage investment cases & insights |   |  |  |   |   |   |   |

Bankable grid scenarios & insights |   |   |  |   |   |  |  |

Bankable hydrogen scenarios & insights |   |   |   | ||||

Bespoke expert support |   |   |   |   |   |   |   |