By Victor Yip, Senior Research Analyst for GB Flex

Setting the scene

Balancing supply and demand in a power system is difficult and vital work. Unlike conventional commodities, power is difficult to store in large volumes for any period of time. For instance, grain or coal can be stored in warehouses at relatively low cost, but electricity cannot be kept in a box. System considerations, particularly around maintaining grid frequency to avoid damaging equipment, or even—in extreme cases—blackouts, drive the need for real-time matching of supply and demand. The physical realities of electricity require systems and operators capable of balancing supply and demand, in real time, 365 days per year, to a tolerance of less than a percentage point.

While this suggests that being able to store more energy would ease the job of grid operators, having significant energy storage capacity has not made this task easy. Nowhere is the seen more so than in Great Britain, which serves as the canary in a coal mine for nascent problems of decarbonising power systems, in no small part because it is one of the most developed power markets in the world.

The Balancing Mechanism (BM) is the tool used in Great Britain to ensure the power system is ‘balanced’. This blog post, the first in a series from Aurora Energy Research, will describe the Balancing Mechanism’s fundamental purpose, its current role, and its direction of travel.

What is the Balancing Mechanism?

The Electricity System Operator (ESO) is responsible for ensuring the stable operation of the electricity system in Great Britain. The BM is the mechanism through which the ESO procures the right amount of electricity to match supply and demand in real time. Beyond balancing, the ESO is responsible for market design, managing the network, and catalysing the energy transition. It does not participate directly in the market for energy; it only enables its operation in a cost-effective manner.

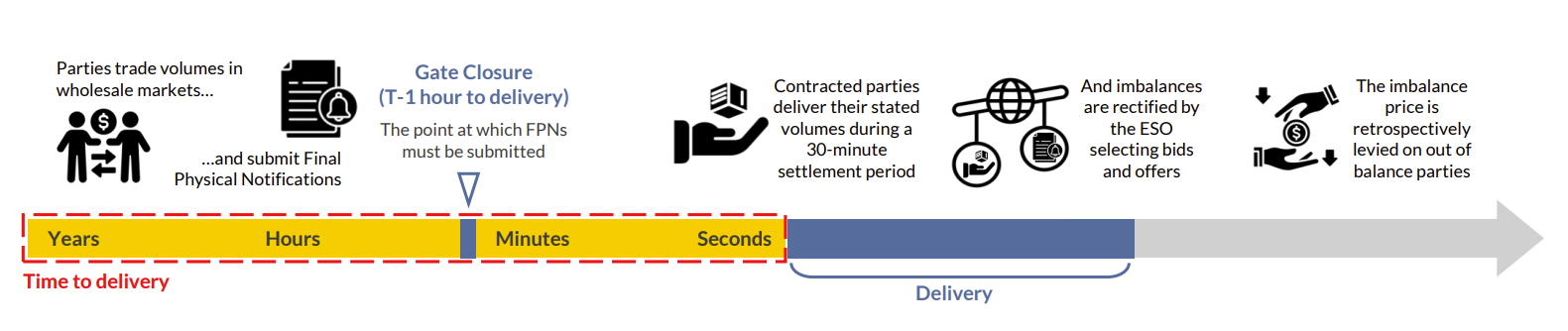

Prior to considerations around real-time balancing, the vast majority of electricity is traded in wholesale markets at timescales ranging from hours to years ahead of delivery. The main parties in wholesale markets are “offtakers”, such as Octopus or EDF who buy electricity from generators and sell to consumers, and generators, such as wind farms who sell to offtakers. These commitments to buy and sell are communicated through physical notifications to the ESO, and through these stated intentions, supply and demand are theoretically matched ahead of delivery—but nothing is ever so simple in real time.

Expectations of generation and consumption are, necessarily, imperfect. Demand is fundamentally determined by human behaviour. As such, when and how demand behaviours change is hard to predict well—and generation is governed by the laws of physics and realities of engineering, which are only slightly less capricious. A person’s decision to boil a kettle will require a tandem action to increase generation from a power plant elsewhere in the country. A sudden gust of wind might increase generation from a wind turbine unexpectedly. A gas plant might break down, or a ship could drag its anchor through an undersea cable. It is these resulting imperfect balances that the ESO or, more specifically, the Electricity National Control Centre (ENCC), aims to reconcile, and the BM is the mechanism through which this is done.

How does the Balancing Mechanism work?

BM participants, principally generators, submit bids and offers to reduce or increase generation, respectively. If their bids and/or offers are accepted, parties are remunerated on a pay-as-bid basis. Based on their own view of demand and the system as a whole, the ESO chooses which bids and offers to accept to balance the grid. The control room receives information on real-time fluctuations in supply and demand, and these are similarly managed in real-time using the bids and offers available.

When parties are out of balance with their stated intention, the imbalance price is levied per MWh of energy that is out of balance with their physical notifications. This price is determined as the most expensive action that the ESO took to balance the system after netting off the most expensive bids and offers. The intention here is to send appropriate price signals to out-of-balance parties that are reflective of actual energy balancing costs, ultimately encouraging parties to operate in support of security of supply.

The selection of bids and offers in the BM is obviously critical to the market outcomes and is the subject of much debate, despite being just a part of the myriad of ways in which the BM must change in response to a transitioning power system. In theory, the optimal way of selecting units is by building up a merit order, ranking the possible actions from lowest- to highest-priced, and then accepting the sequence of actions that balances the grid at the lowest cost.

The Balancing Mechanism in transition

The process of bid and offer selection for the last few decades, since the BM’s inception in 2001, has been driven by manual decisions. This worked well enough within the previous paradigm of the power generation mix, which was predominantly centralised between a few large thermal generators. Thermal plants operating as baseload provided significant inertia which increased the resilience of the wider system to changes in frequency. Centralised generation trivialised voltage considerations as power flows were predominantly unidirectional, moving from supply to demand only. Finally, having fewer, larger plants reduced the decision space for system operators, enabling a manual approach to unit selection to suffice.

However, realities of a decarbonising electricity system are disrupting these conditions, namely through increasingly decentralised power generation, smaller units, and falling inertia. As a result, the system operator in GB increasingly needs to take and pay for actions for technical reasons rather than economic ones.

The next blog post in this series will look at what happens when Balancing Mechanism Units are not selected in their apparent merit order, why this happens in more detail, and how it impacts battery business cases.