Stay ahead in the Nordic energy market

Nordic renewables are expanding rapidly, with subsidy-free wind now viable due to maturing PPA markets. Price volatility is rising due to regional price divergence and interconnection with EU markets. Hydropower remains a key balancing tool, but growing intermittency in the power mix highlights the need for flexible assets and strategic positioning in evolving market conditions.

Our fleet of products

Aurora's bespoke advisory services

Transaction and financing guidance

Trusted by industry leaders

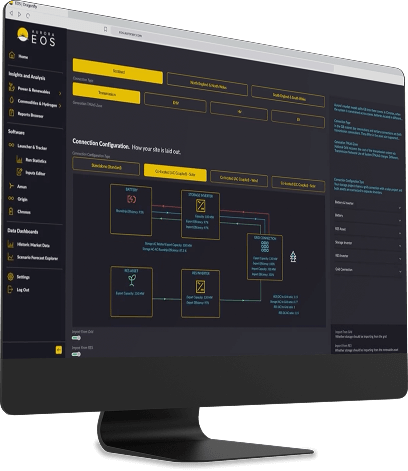

Integrated energy intelligence with EOS

EOS is Aurora's unique, interactive energy intelligence platform, providing clients with seamless access to software, data, forecast reports, and insights essential for strategic decision-making.

Used by thousands of energy market professionals each week globally, EOS serves as the central hub for all our software and research subscription services, enabling users to efficiently access our intelligence, whatever their use case.