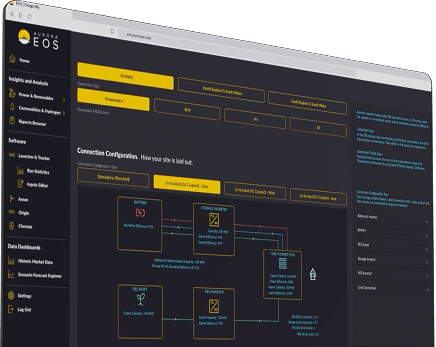

We provide decision-makers with actionable intelligence

to navigate and capitalise on the global shift in energy systems.

Clients

+

Countries

+

Transactions

+

Advisory Projects

Strategic market focus

for your sector

Financial Sector

For informed capital allocation in evolving energy landscapes, energy investors trust Aurora's analytical rigour and regulatory expertise.

Energy Consumers

Large-scale businesses optimising energy procurement, balancing cost-efficiency, reliability, and sustainability while meeting operational and regulatory requirements.

Utilities

Organisations managing energy generation, transmission, and distribution, optimising grid performance and integrating renewables to meet future energy demand.