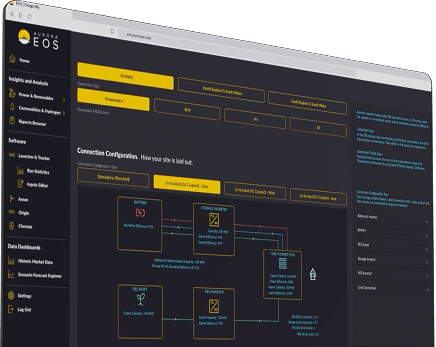

We provide decision-makers with actionable intelligence

to navigate and capitalise on the global shift in energy systems.

Clients

+

Countries

+

Transactions

+

Advisory Projects

Strategic market focus

for your sector

Financial Sector

For informed capital allocation in evolving energy landscapes, energy investors trust Aurora's analytical rigour and regulatory expertise.

Energy Consumers

Large-scale businesses optimising energy procurement, balancing cost-efficiency, reliability, and sustainability while meeting operational and regulatory requirements.

Utilities

Organisations managing energy generation, transmission, and distribution, optimising grid performance and integrating renewables to meet future energy demand.

All voices, all markets

Article

The Limits To Growth: The Malaysian Way of Navigating the Data Centre Boom

Public Webinar

Curtailment in Spain: How exposed will your assets be?

Market Report

Western Regionalization: Day-Ahead Market Benefits Analysis for Arizona Balancing Authorities